InP Related R&D in Japan, Taiwan and Asia

ATIP/Japan

Copyright © 1995-2009 by the Asian Technology Information Program (ATIP).

This material may not be published, modified, or otherwise redistributed in whole or in part, in any form,

without prior approval by ATIP, which reserves all rights.

ABSTRACT: The 16th International Conference on InP and Related Materials (IPRM04), held in Kagoshima (May 31 to June 4, 2004), provided an opportunity to assess recent developments in III-V compound semiconductor materials and devices in Japan and other Pacific rim countries.

This report is a review of the status of InP related R&D in Asia based on presentations given during the IPRM04, with particular emphasis on trends in the development of quantum dot lasers, large area InP substrates, and new materials research on thallium compound semiconductors for infrared devices.

KEYWORDS: Advanced Materials, Conferences, Nanotechnology, Physics, Regional Overview

of Science and Technology, Photonics/Optoelectronics, Semiconductors,

Telecommunications/Internet

COUNTRY: Japan

DATE: June 30, 2004

REPORT CONTENTS

1. INTRODUCTION

EXECUTIVE SUMMARY

TOPIC/COUNTRY ASSESSMENT

2. BACKGROUND

3. IPRM04

4. KEY PRESENTATIONS

4.1 Korea

4.2 Singapore

4.3 Taiwan

ATIP Document ID: 040630AR ATIP04.028: InP Related R&D in Japan and Pacific Rim

1

4.4 China

4.5 Japan

5. CONCLUSION

6. CONTACTS & WEBLINKS

1. INTRODUCTION

Over the last thirty five years, Japan has made significant contributions to the development of III-V (read as “three-five”) compound semiconductor materials and devices. Examples of major contributions by Japanese engineers and scientists include: 1) the development of GaAs semiconductor lasers by Dr. Izuo Hayashi, 2) the development of optical fiber communications, in particular long wavelength semiconductor lasers and photonic integrated circuits by the Tokyo Institute of Technology group, 3) the invention and commercialization of HEMT (high electron mobility transistor) by Fujitsu in the early 1980s, and most recently, 4) the fabrication of GaN blue LEDs by Nakamura and Akasaki. Although eclipsed by the R&D on gallium nitride of late, Japan’s indium phosphide community is still active and waiting for resumption of investment in InP based optoelectronics, following the excesses the IT fever and subsequent downturn in 2000. (For a companion report on InN research, see ATIP04.026.)

The InP and Related Materials conference was established sixteen years ago, following an

initiative led by Japanese researchers. This event is held annually, moving between the US, Japan, and Europe, and is the most important meeting for researchers in the field. The Kagoshima conference was sponsored by the Japan Society of Applied Physics, IEEE Lasers and Electro-Optics Society, IEEE Electron Devices Society, and several industrial sponsors.

This year’s conference was chaired by Dr. Yuichi Matsushima of the National Institute of Information and Communications Technology (NICT) in Tokyo. The event gathered 350 participants from 16 countries and included 3 plenary talks, 25 technical sessions, and 199 presentations. The proceedings covered the six areas of characterization and bulk materials, epitaxy, processing and materials integration, electron devices, optoelectronics and nanostructures, and novel materials.

The present report reviews the presentations and technical discussions of IPRM04 and assesses trends such as outsourcing, the role of Asian academia and industry, and new devices in the next decade.

|

ATIP offers a full range of information services, including reports, assessments, briefings, visits,

sample procurements, workshops, cultural/business sensitivity training, and liaison activities, all

performed by our on-the-ground multilingual experts.

Email: info@atip.org Website: http://www.atip.org

|

|

Japan Office:

ATIP Japan LLC

MBE 221, Akasaka Twin Tower

2-17-22 Akasaka, Minato-ku,

Tokyo 107-0052 JAPAN

Tel: + 81 3 5411-6670

|

U.S. Office (HQ):

ATIP

PO Box 4510

Albuquerque, NM

87196-4510

USA

Tel: +1 (505) 842-9020

Fax: +1 (505) 766-5166

|

China Office:

ATIP

QingYun Modern Plaza, #2029

No. 43, W. Northern 3rd Ring

Road

Haidian District

Beijing 100086 China

Tel: +86 (10) 6213-6752

Fax: +86 (10) 6213-6732

|

Complete ATIP reports on Asian Science and Technology are provided to subscribers and

collaborating organizations by direct distribution, or via electronic access. These contain text and often, charts, graphs, and pictures. Reports for unrestricted distribution often contain summarized or abstracted information. Sponsors can also obtain specific follow up information, including copies of proceedings, selected papers, exhibition particulars, updates, translations, query searches, etc.

END OF REPORT ATIP04.028a

[The remaining sections of this report are available to ATIP subscribers]

ATIP04.028: InP Related R&D in Japan, Taiwan and Asia

Copyright © 1995-2009 by the Asian Technology Information Program (ATIP).

This material may not be published, modified, or otherwise redistributed in whole or in part, in any form,

without prior approval by ATIP, which reserves all rights.

EXECUTIVE SUMMARY

l InP and related III-V compound semiconductors are used for fabricating HEMT, HBT (heterostructure bipolar transistor), as well as heterostructure lasers and other devices used in communications (fiber optics, wireless, direct broadcast satellite); computers (information, DVD, speed), and other consumer products (data storage and health care).

l In spite of the severe downturn in the InP industry in 2000, with many bankruptcies and takeovers, according to a 2002 report published by Strategies Unlimited, the world market for InP was predicted to exceed $500 million by 2007.

l The InP and Related Materials Conference (IPRM) was established sixteen years ago and is held annually; it is the most important meeting for engineers working in the field. A significant increase in participants from Pacific Rim countries was noted at IPRM04, which was held in Kagoshima, Japan, reflecting notable technological developments in Asia over the last five years: growth (MBE, MOCVD, LEC), fabrication (EBL), and packaging of state of the art optoelectronic devices.

l Engineers in Japan and neighboring countries have succeeded in fabricating operational quantum dot lasers manufacture of large area InP substrates. Commercial lasers and systems can be expected within the next 3 to 5 years from the Asian industry.

l The launch of Eudyna Devices Inc. (April 2004;capitalized at 19.5 billion yen, approx US$190 million), a 50-50 joint venture between Fujitsu Quantum Devices Limited and Sumitomo Electric, emphasizes the growing competition in the III-V and InP semiconductor market as well as the expectation of an upturn in the next 3 to 5 years.

IMPACT & ASSESSMENT

InP-based products and devices are used by industries involved in fiber optics, direct broadcast satellite, DVD, and data storage. The exponential increase in demand for realtime global networking will necessitate the procurement of optoelectronic components manufactured, using InP-based semiconductors. The present report offers valuable insights into newcomers in Asia who will be part of the network of manufacturers competing with their Western counterparts for a share of the next generation of the global telecommunications market.

TOPIC / COUNTRY ASSESSMENT

The following table provides ATIP’s evaluation and assessment of current and evolving country-level capabilities in a variety of technologies related to InP. It is based on the conference presentations as well as interactions with people directly working in the noted fields. Capabilities are rated from zero to four “+” with added comments as appropriate.

Topic [InP substrate manufacturing]

2004 2007 (estimate)

China + +++

(strategically important for the development of China's optoelectronics industry)

Japan +++ ++++

(solid technological base; just waiting for the markets to improve)

Taiwan zero +

(mainly due to outsourcing from Japan)

Singapore zero zero

Korea zero +

(Korean conglomerates want this technology; it is only a matter of time)

Topic [Quantum dot laser products]

2004 2007 (estimate)

China zero zero

Japan zero ++

(domestic development)

Taiwan zero ++

(mainly due to outsourcing from Japan)

Singapore zero zero

Korea zero +

(as a result of intense national efforts)

Topic [mass production of HEMT, HBT devices]

2004 2007 (estimate)

China zero +

(due to new venture businesses)

Japan +++ ++++

(strong base; waiting for market upturn)

Taiwan + ++

(mainly due to outsourcing from Japan)

Singapore zero +

(but only with government support)

Korea + ++

(Samsung et al; challenge Japanese dominance)

Topic [mass production of lasers and PICs]

2004 2007 (estimate)

China zero +

(very large telecommunication market will necessitate domestic industry )

Japan +++ ++++

(strong base; waiting for market upturn; Chinese telecom. market will be triggered)

Taiwan + ++

(mainly due to out sourcing from Japan)

Singapore zero +

(but only with government support)

Korea ++ +++

(again Samsung et al; challenge Japanese dominance)

ATIP comments on table:

Outsourcing from Japan to Taiwan: ATIP expects companies from other countries (mainly Japan) to outsource their work to Taiwan once the opto-electronics market improves again and the supply cannot meet demand.

Readers may be surprised that China is rated above Korea and Taiwan in one specific area, the manufacture of InP substrates, both today (2004) and in 2007. This was based on the papers presented at the conference (no papers from Korean or Taiwanese engineers about InP substrate manufacture but ~3 from Chinese engineers) as well as conversations with other experts at the conference.

It is relatively easy to start the manufacture of HEMT/HBT and laser structures: buy the substrates, buy the deposition technology such as MOCVD or MBE, read papers about the basic device structures, and off you go. The manufacture of III-V substrates, in particular InP, takes a great deal of time and effort with much more in-house, craftsman-type know how in order to produce a useful product. It takes time to develop InP substrate manufacturing technology, and there are no simple 'plug-in and use' solutions.

The Chinese have a tradition of working with crystal pulling techniques such as LEC for the fabrication of III-V substrates and as the conference papers show, there have been dramatic improvements in their ability to manufacture InP substrates over the last 5 years.

On the other hand, there were no papers from Korean or Taiwanese institutes/industry on

this topic and ATIP has not heard either of any concerted efforts from these countries to

develop such technology.

ATIP believes China will build on its recent success on InP substrates. ATIP also expects this country to have a noticeable industry within the next 3-5 years for its domestic use, hence the +++ for China in 2007.

2. BACKGROUND

InP is extensively used for 1300–1550nm wavelength optical communication devices with 75% of the market being InP based lasers, 20% optical receivers, and the remainder electronic devices such as HEMT and HBT. Expanded use of optical fiber networks for WDM systems has led to greater demand for long wavelength InP laser diodes and photodiodes. In addition, compound semiconductor devices are increasingly used for cell phones, DVD systems, and visible light LEDs. The InP market is greatly affected by the investment in optical fiber network equipment by local authorities and governments. In the medium term, the optical communications market is expected to expand in China and Asia. According to a 2002 report published by Strategies Unlimited, the world market for InP was predicted to exceed $500 million by 2007.

Driven by demands for high performance automobile radar and high speed optical and

microwave/millimeter wave communication systems, there has been a growing interest for ultra high frequency devices and peripheral technology operating at 100Gbit/sec. The competing technologies are InP HBT, InP HEMT, GaAs p-HEMT, and SiGe BiCMOS. The successful technology will be the one offering the highest bit rate density at the lowest cost, that is, the highest integration with the lowest power consumption. Existing WDM (wavelength division multiplexing) systems use 10Gbit/s devices and will be replaced by 40Gbit/s networks as Internet traffic continuous to increase. Silicon has shown tremendous resilience and Si integrated circuits capable of 40 Gbit/s have been produced; however, their shortcoming is that they consume more power than their 10Gbit/s predecessors and do not represent a solution to the problem of increasing speed and reducing power consumption.

InP based compound semiconductors and ICs have been studied for more than 30 years and many experts agree that they will be the key technology for the niche areas in optoelectronics where silicon cannot be used. The characteristic features of InP based devices offer the following advantages over silicon and GaAs technology: 1) better thermal characteristics, 2) higher breakdown voltage, 3) higher frequency response, and 4) lower threshold voltages.

The bursting of the IT bubble led to a severe down turn in the InP industry with many bankruptcies and takeovers. In Japan, many university projects shifted their emphasis to other areas such as nitrides and industry has reduced its efforts on speculative projects. Basic research has become a luxury that even the major Japanese companies are not funding unless it is part of national projects led by JST, NEDO, etc., where the government funds most of the equipment and human resources.

The April 1, 2004 announcement of the launch of Eudyna Devices Inc, a 50-50 joint venture (capitalized at 19.5 billion yen; approx US$190 million) between Fujitsu Quantum Devices Limited and the electronic devices division of Sumitomo Electric, reflects not only the growing competition in the III-V and in particular InP semiconductor market, but also the expectation that there will be an upturn in the near future.

The last few years of reduced activity in the InP sector has enabled researchers in Korea,

Taiwan, and Singapore to develop technology to compete with industries in the US, EU and Japan. One of the results of this activity has been that engineers in Korea and Singapore are now able to fabricate state of the art InP based HEMT and HBT devices. Further, China has made tremendous advances in the growth of large area InP substrates (Hebei Semiconductor Research Institute) that will affect market trends given the advantages in manpower costs in China compared with Japan and US/EU.

The InP industry could be seen as having matured and experienced its first cycle of growth followed by contraction that is usually associated with the silicon industry. The future will require greater emphasis on outsourcing and globalization.

3. IPRM04

IPRM04 was chaired by Dr. Yuichi Matsushima (NICT) and held at the Kagoshima Bunka Hall. Kagoshima city is called the Napoli of Japan because it is located on the coast facing

Sakurajima, a 1200m active volcano.

The proceedings covered the six areas of characterization and bulk materials (17), epitaxy (27), processing and materials integration (18), electron devices (47), optoelectronics (51), as well as nanostructures and novel materials (39). The numerals in brackets indicate the number of papers in the session.

Excluding on-site registration, there were 18 participants from Korea, 11 from Taiwan, 7 from Singapore, and 5 from China. This increase in the number of participants from Asia reflects the major advances in the field in these countries over the last three years.

4. KEY PRESENTATIONS

4.1 Korea

The majority of reports from Korea originated from institutes funded as part of the 21 Century Frontier Programs. The main funding agencies are the Ministry of Science and Technology as well as the Ministry of Information and Telecommunications.

InP HEMT devices have tremendous potential for use in space and military systems due to

their extremely high cut off frequencies and transcondunctances.

The Seo group from Seoul National University (as part of the National program for Tera hertz level integrated circuits funded by the Ministry of Science and Technology) described the fabrication and electrical characteristics of a W-band MMICs (mixer, oscillator, distributed amplifier) using 60nm gate length InAlAs/InGaAs HEMT grown by solid source MBE, which showed Vth=-0.65V, VB=-4.1V, extrinsic transconductance = 1.15 S/mm, ft=250 GHz and fmax= 263 GHz. A 1.5 x0.7mm2 ultra broad band distributed amplifier showed a small signal gain of 6.6dB over 0.4~110 GHz. This group has developed electron beam lithography and MBE growth technology for producing these state of the art devices. The technology to fabricate such devices was not readily available in Korea five years ago.

Impact ionization in the narrow band gap of InGaAs (< 0.75eV ) strained channel layers in metamorphic InAlAs/InGaAs HEMT structures leads to premature channel breakdown and excessive microwave noise, thus necessitating technology for the passivation of the sides of InGaAs gate recesses. This group successfully used RPCVD for depositing silicon nitride layers in order to passivate InGaAs metamorphic HEMT.

There were three other related papers on HEMT devices. This group is working with WAVICS Co Ltd, Seoul, on HEMT-MMIC related research.

The Electronics and Telecommunications Research Institute (ETRI)

The use of GaAs substrates is a low cost alternative to InGaAs/InAlAs HEMT devices that are usually grown lattice matched to InP substrates. The problem of the mismatch between GaAs substrate and InAlAs/InGaAs epilayers is overcome by growing a metamorphic structure. The growth and subsequent fabrication of metamorphic HEMT structures is a technologically demanding undertaking that requires a deep understanding of band gap engineering, crystal growth, and processing procedures. The Electronics and Telecommunications Research Institute (ETRI) group showed that they have the ability to fabricate such devices and described the microwave performance of 150nm T-gate metamorphic InAlAs/InGaAs M-HEMT on GaAs substrates with ft and fmax of 150GHz and 240 GHz, respectively. The small signal gain of 1.7mmx 2mm chip, 3 stage M-HEMT MMIC amplifier was reported to be 13.5 dB at a maximum output of 7dBm.

Distributed Bragg reflector (DBR) lasers are attractive as light sources for monolithic photonic integrated circuits such as the master oscillator power amplifier. One of the important requirements for implementing high performance DBR lasers is to reduce the absorption loss in the DBR region. Further, tunable laser diodes are expected to play an important role in WDM networks. High output power of the order of 10mW is desired but this is considered difficult to achieve without sacrificing the wide wavelength tenability. This group reported on the fabrication of multisection tunable single mode ampled-grating DBR lasers monolithically integrated with semiconductor optical amplifiers. Fiber coupled output power exceeding 10dBm at CW operation was reported.

The delta function like density of states resulting from the incorporation of quantum dots (QDs) in the active layers of semiconductor lasers are expected to lead to improvements in their performance, including lower threshold current density, larger differential gain, lower chirp, and reduced temperature dependence compared to quantum well and bulk lasers. This group reported on the optimization of the growth of InGaAs QDs (dimensions of between 32nm x 4.5nm to 66nmx6.6nm; density of 8x10 10 cm-2) inside InGaAsP barriers by MOCVD on (001) InP substrates. The emission wavelength of the lasers was between 1350nm to 1650nm and controlled by varying the composition of the InGaAs dots. The threshold current density was measured to be 3.3kA/cm2 at 200K. This research was funded by the National R&D project for Nano Science and Technology.

Samsung Electronics Co.

This company is internationally known for the manufacture of electronics components such as flat panel displays. As presentations made at this IPRM04 conference showed, in recent years, Samsung has also been investing in InP based research on InGaAsP lasers.

The Network Research Team of Samsung’s Telecommunications R&D center reported on the fabrication of InGaAsP quantum well spectrum sliced amplified spontaneous emission (ASE) injected wideband gain lasers, covering the C-band wavelength channels. The WBG laser diodes were used as 155 Mb/s wavelength division multiplexed-passive optical network (WBG-PON) with a feeder fiber of 25 km and AWGs with 100 GHz channel spacing.

Members of the same center also described their work on the selective growth of AlGaInAs on silicon dioxide masks for fabricating ridge waveguides for spot size converter integrated laser diodes for low cost laser modules by eliminating expensive components such as the lens and thermo-electric cooler.

A group from Samsung’s Photonic Solutions Laboratory reported on the fabrication of

10Gb/s InGaAs/InP avalanche photodiodes fabricated using the non local mode. Control of the multiplication layer thickness is important in order to achieve high gain and large bandwidth. The InGaAs/InP APD were designed based on the non local mode and grown by MOCVD. The dark current was less than 1 nA and gain bandwidth larger than 80GHz.

4.2 Singapore

Nanyang Technological University

The incorporation of nitrogen (N) into InGaAs QDs is expected to reduce the bandgap (1% N will cause ~200meV shift which is larger than the 154meV shift needed to tune the wavelength from 1300 to 1550nm) and also compensate the compressive strain due to the indium for fabricating long wavelength lasers. An InGaNAs laser was recently

demonstrated with a low threshold current density of 350 A/cm2 at 270K and lifetime of over 1000 hours. Self organized GaInNAs QDs were grown by gas source MBE to a density of ~10 10 cm-2. Oxide stripe edge-emitting, laser diodes with GaInNAs QD were raised showing RT CW operation at 1200nm. The output power and threshold current were 16mW and 2kA/cm2, respectively. The observation of room temperature laser oscillation is notable and will add momentum to this field of study.

Four other papers on the use of polyimides for InP/InGaAs HBT passivation, drain transients in InAlAs/InGaAs HEMT, and the use of photoluminescence for studying structural stability of metamorphic InP/InGaAs HBT and HEMT structure after rapid thermal annealing were presented.

4.3 Taiwan

The group from National Sun Yat-Sen University used the Kramers-Kronig model for a theoretical study of the refractive index of InP quaternary compounds at photon energies near and above the band gap.

A group from the same university in collaboration with ITRI (Industrial Technology Research Institute), Taiwan’s largest public laboratory, reported on the reverse bias dependence of the photocurrent and differential absorption of InGaAsN/GaAs (N=2%) single (SQW) and double quantum well structures (DQW). These so called, ‘dilute nitrides’ are considered alternative materials for InGaAsP/InP photonic devices operating in the 1300 to 1600nm wavelength range. The absorption spectra increased in amplitude and showed a red shift above 1200nm wavelength as the bias decreased from 0 to -6 volts. Further, the electroluminescence of the DQW structure was found to be 2.6 times larger than SQW structures. These results make these structures particularly promising for chipfree traveling wave EA modules.

The National Central University

Researchers from NCU reported on improvements in the on-resistance and power performance of InGaP/GaAs DHBT by the introduction of a 350nm thick GaAs layer into the collector region. The improved performance was due to the higher electron mobility of the GaAs layer. The group used MOCVD to grow the devices on 4-inch GaAs substrates and non-self aligned technology for fabrication. Growth on large area substrates indicates the maturity of the technology in this Taiwan.

The Chan group, in work sponsored by the MOE (Ministry of Education) program for promoting academic excellence of Universities, reported on the MBE growth of InAlAs/InGaAs metamorphic HEMT on GaAs substrates. The 250nm to 650nm gate length structures were fabricated using electron beam lithography and found to have extremely large electron velocities of 2.8x107 cm/s at indium content of 60% in the InGaAs channel. These devices are promising for low noise applications in the millimeter range.

In work funded by the National Science Council, the HH Lin group used a VG V80H solid source MBE system used for growing three stacks of InAs self organized QDs on GaAs substrates for InAs/InGaAs QD lasers of 1214nm wavelength and threshold current of 124 A/cm2. The internal loss in quantum efficiency of the QD lasers was 2.5 cm-1 and 74%, respectively. The present report reflects the strong interest and expectations in the development of QD lasers in Pacific Rim countries.

4.4 China

Contributions from China were focused on the development of indigenous industries for growth of large area InP substrates. The in-situ injection of phosphorous into the melt during LEC growth has been shown to yield InP wafers with low defect density. However, the LEC process is difficult due to the high phosphorous pressure at the melting point (27.5 atm and 1335K). N. Sun of Hebei Semiconductor Research Institute described the growth of 3 and 4 inch Sn doped InP wafers by a method combining phosphorous injection followed by high pressure liquid encapsulated Czochralski (HP-LEC) method using only a single chamber. The figures of merit of a typical 160 mm diameter (100) InP wafers were:

- Three -inch: mobility= 2260 cm2/Vs; etch pit density=0.3x 104 cm-2; carrier conc.= 0.7x 1018 cm-3

- Four-inch: mobility = 1600 cm2/Vs; etch pit density=3.7x104 cm-2;carrier conc.=

2.8x 1018 cm-3

The use of a ‘large shoulder angel’ was demonstrated to enable the realization of twin-free

material.

Doped InP substrates are the foundations of optical devices such as LEDs, and photodetectors. The capability to grow such wafers in China will be important for the development of the Chinese optoelectronic industry.

4.5 Japan

HEMT and HBTs

Dr. Murata of NTT, Atsugi, grew InAlAs/InGaAs/InP HEMT structures on 3” InP substrates by MOCVD and fabricated devices exhibiting ft=186 GHz, fmax=320 GHz, gm=1.2 S/mm with a Vth variation of 13 mV over a 3inch wafer. The NTT group is also working on reaching the goals of its HBT roadmap, including HBTs for full rate 100 Gbit/s circuitry such as 3rd generation InP D-HBTs. Recent results of D-HBTs grown on 3-inch InP substrates, with a 0.6μm emitter, 150nm collector and 30 nm pseudomorphic base, showed the devices with ft= 340 GHz, fmax= 492GHz,Jc= 6 mA/μm2, and ECL gate delay=3.48 pS. Prototype 100 GHz PRBS pulse generators were shown to exhibit ‘true’ signals with an RMS jitter of ~700 fs. Further progress in this field will depend on overcoming shortcomings due to electrical connections by use of OEIC technology.

Materials and Optical In-Situ Monitoring

Carbon is used as a low diffusivity dopant for fabricating high performance optoelectronics devices. The Mitsubishi Chemical group presented its results on carbon doped InAlGaAs/InP 1mm cavity length laser diodes for 1.3 μm wavelengths. The use of InAlGaAs/InP offers a large conduction band offset with carbon doping enabling sharper doping profiles due to the low diffusion coefficient of carbon in InAlAs. The InP/InAlAs/InP (S-doped (100) substrate) structures were grown by MOVPE, with the InAlAs layer grownat 550 C and CBr4 used to dope it ~1x10 18 cm-3. The carbon doped devices showed better performance than Zn doped structures, with no phase separation and a maximum power of 150 mW.

The importance of in-situ monitoring of material parameters for increasing the yield of production epitaxial wafers was emphasized by several speakers. Dr. Watatani (Mitsubishi Electric Corp) described the use of reflectance spectroscopy for in-situ monitoring of AlGaInP during MOVPE growth. Their method employs Fabry-Perot oscillations and the film growth rate and Al content can be determined independently of the structure. This method is expected to be applicable for monitoring other materials as well.

The session on ‘new materials for MBE’ yielded conflicting opinions about the incorporation of thallium (Tl) in semiconductors for infrared devices covering the 1.7-10μm range. The addition of Tl has the added benefit that the band gap energy of such semiconducting compounds is predicted to be independent of temperature.

Dr. Asahi’s group from Osaka found a reduction in the temperature coefficient of the refractive index and energy gap of TlInGaAs/InP (gas source MBE) with increasing Tl content. The temperature dependence of TlInGaAs/InP laserd diode structures (Tl=6%; 70 μm wide; 300 μm long; emission wavelength =1665 nm) in the LED mode was 0.06nm/K between 200-330K. Pulsed laser action was also observed between 77-310K, where the temperature coefficient of the LO peak was 0.06nm/K, which is smaller than the

0.1nm/K for InGaAsP laser diodes. These results contradict the reports by the ECL (Ecole Centrale de Lyon) from France, which found that is was possible to incorporate a maximum of 4% of Tl into an In0.46Ga0.53As matrix at relatively growth temperatures of 200-230°C. The optimum conditions for growth of Tl semiconductors still requires clarification.

Dr. Kawase (Sumitomo Electric Industries) reported on the growth of 3” and 4”, semiinsulating Fe doped InP substrates grown by liquid encapsulated growth (LEC), vapor controlled Czochralski (VCZ), and the recently developed vertical boat (VB) method. The VB method was demonstrated to produce superior results, where 4” Fe doped substrates had a dislocation density of 2,500 cm-2 and a resistivity uniformity variation of 3.9% from a nominal value of 2x107 ohm-cm. The superiority of the VB method is attributed to the ability to grow single crystals under a low temperature gradient of 5-20 °C/cm because InP decomposition is suppressed by total encapsulation.

Nikko Materials grew low dislocation 3 and 4 inch Fe doped InP substrates by phosphorous vapor controlled LEC. Dislocations densities of the 3 and 4 inch substrates were ~500 cm- 2 and ~5000 cm-2, respectively. These substrates will be particularly useful for fabricating photo diodes with low dark currents.

Quantum Dots

In an invited talk, Dr. Tsukamoto of Tokyo University, described his work on the use of STM for in-situ monitoring of InAs quantum dot growth on GaAs(001) substrates during MBE growth.

Quantum dots are promising for 1.3μm to 1.55μm range laser applications as predicted by Arakawa and Sakaki, in 1982. The use of self-organizing growth has been extensively investigated by many groups worldwide. The problem of in-situ monitoring during MBE growth is still unresolved since RHEED, although being useful for monitoring 2D growth, cannot be used to monitor and control the size of QDs that occurs as 3D growth. The use of docked, but separate MBE and STM chambers, where the deposition QDs is followed by rapid quenching (50°C/s) and samples are transferred (~2s) to the adjacent STM chamber, offers snap shots, and not real time images. Real time imaging during growth is preferable but there are still problems related to the contamination of STM instrumentation and probes located inside an MBE chamber. Dr. Tsukamoto has ingeniously managed to locate the STM within an MBE chamber and recorded the evolution of InAs QDs on GaAs over a wide range of growth conditions. His group has found no evidence for a highly mobile layer of In or InAs. On average, the InAs QDs were 1.7nm high and 5nm wide with a density of ~6x10 11 cm-2.

Dr. Yamamoto (National Inst. Of Information and Comm., Koganei) observed continuous wave laser emission from InGaSb QD VCSEL structures grown on GaAs substrates. The density of InGaSb QDs in the active region was increased by irradiating the GaAs surface with silicon atoms (~4x1011 cm-2) under an Sb flux of ~4x10-7 Torr. A record, 4.4x109 cm-2 InGaSb QDs were produced by use of Si irradiation, which is a factor of 100 greater than without Si irradiation. The InGaAs QD VCSEL structure showed cw operation at room temperature, at an emission wavelength of ~1.34μm, and threshold current density of 310 A/cm2.

In the session dedicated to electroabsorption modulators, Dr. Fukano (NTT Photonics, Atsugi) demonstrated the development of a 40 Gbit/s InGaAlAs/InAlAs modulator, with an RF extinction ratio of 10dB, operating at Vpp of 1.1V, a voltage which is less than half that of other such devices terminated at 50 ohm.

Short Summaries of Other Notable Contributions

Dr. Yamada, Sumitomo Electric Industries, Ltd: PL, PR, and FTIR measurements showed the origin of the weak luminescence from GaInNAs grown by MOVPE to be due to nonradiative centers arising from the spatial inhomogeneity of nitrogen and the existence of N-H bonds.

Dr. M. Yoshimoto, Kyoto Institute of Technology: epitaxial layers of GaNAsBi were grown on GaAs (001) by MBE. GaBi molar fraction of up to 4.0% and GaN molar fraction up to 8.0% were achieved.

Dr. Uchiyama, Hitachi CRL: Reported that fluorine penetration into the channel layer and stacking of fluorine atoms in the Si-planar doped layer was responsible for RIE damage in InGaAs/InAlAs pseudomorphic HEMT. A n ultra-thin InSb barrier layer above the Si-planar doped layer was found to suppress degradation.

Dr. Fukuyama, NTT Photonics Laboratories: Development of a parallel feedback amplifier using InP/InGaAs double heterojunction bipolar transistor IC technology with a gain of 14 dB and 91GHz bandwidth, at 100-Gbit/s operation. It is said to be the highest bandwidth attained to date for base band parallel feedback amplifiers.

Dr. Shirai, Mitsubishi Electric Corp: Development of high performance10Gbps, direct modulation 1.3μm AlGaInAs-MQW ridge waveguide DFB LDs with output power of 5mW, operating at 120ºC.

5. CONCLUSION

The key drivers in the III-V and InP industry are communications (fiber optics, wireless, direct broadcast satellite), computers (information, DVD, speed), and consumers (data storage, and health care). The decline in sales of III-V related technology in the year 2000 or so resulted in a major down scaling of the InP industry. However, the vast majority of industrialists were optimistic about a brighter future as excess capacity is consumed with the prospects for increases in demand within the next few years. In particular, return on investment will depend on the implementation of new strategies, which include using large wafers sizes, (12 x 4” OMVPE; 1x12” by MBE; 12” silicon substrates) and outsourcing the production of wafers and device fabrication to reduce development and production costs.

The InP industry has shown signs of maturity following the ‘boom-bust’ cycles associated with the silicon technology. Future industrial strategies will have to allow for more cyclic movements, and it is expected that there will be an increasing need to establish new infrastructure such as chip foundries and outsourcing as used in the Si industry.

In-situ monitoring will become indispensable for increasing the yield of structures produced by both MOCVD and MBE. The use of optical methods such as RAS will be key technologies for attaining good thickness, temperature and growth rate uniformity during the growth of optoelectronic device structures.

Quantum dot lasers, grown by both MBE and MOCVD, have been produced by engineers in Japan and neighboring countries. The next 3-5 years will see reports of commercial

applications of such devices from Asian industries.

The IPRM05 will be held in Glasgow, Scotland, May 8-12, 2005.

6. CONTACTS & WEBLINKS

IPRM05

http://www.iprm05.org/

Yuichi Matsushima, IPRM04, Conference Chairman

National Institute of Information and Communications Technology

Information & Network Systems Department

4-2-1 Nukui-Kitamachi, Koganei, Tokyo 184-8795 Japan

Fax: +81-42-327-6672

E-mail: matsushima@nict.go.jp

http://www.nict.go.jp

Seoul National University

http://www.snu.ac.kr:6060/engsnu/index.html

The Electronics and Telecommunications Research Institute (ETRI)

http://www.etri.re.kr/eindex.html

Samsung Electronics Co.

http://www.samsung.com/index_01.htm

Nanyang Technological University

http://www.ntu.edu.sg/publicportal/

National Sun Yat-Sen University

http://www.ora.nsysu.edu.tw/ensysu/

The National Central University

http://www.ncu.edu.tw/

END OF REPORT ATIP04.028r

The research for this report was funded in part by the Office of Naval Research (ONR) grant #

N00014-04-1-0396

Published on 29 October 2008

by Electronics news desk

Intel will take the wraps off its new 32nm process technology for microprocessors at the International

Electron Device Meeting (IEDM) in December.

Intel claimed it is onto a second-generation high-k/metal gate technology and will, for the first time,

adopt 193nm immersion lithography to scale down the gate length. The company claimed its process

has the highest drive currents reported to date for a 32nm technology. The NMOS saturated drive current is 1.55mA/μm while the corresponding PMOS value is 1.21mA/μm.

Intel researchers used the process to build the largest fully functional SRAM array yet reported: a 291Mb SRAM array test chip with a cell size of 0.171μm2 and an array density of 4.2 Mb/mm2. The test chip operated at 3.8GHz at 1.1 V.

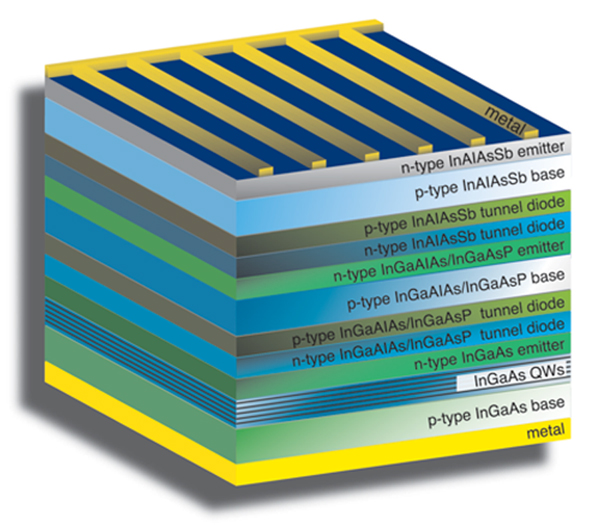

Also at the conference, researchers from HRL Laboratories will describe a possible shortcut to put the high speed of indium phosphide-based transistors into CMOS chips. They built entire wafers of high-performance 250nm double-heterostructure bipolar transistors able to switch at up to 300GHz on IBM’s 130nm RF-CMOS technology.

A partially fabricated wafer is bonded to a full-thickness, but smaller, InP epitaxial wafer. The InP wafer first is temporarily bonded to a handle wafer which allows the InP growth substrate and etch-stop layers to be removed. An aluminum heat-spreader layer is deposited as a blanket film, then the InP DHBT layers are permanently bonded to the IBM CMOS wafer’s top surface. In a first, the CMOS transistors showed no sign of degradation, while the InP transistors showed only minor performance impacts.

A further late paper is work from Tohoku University where magnetic tunnel junctions (MJTs) rather than SRAM cells are used to store data in a high-density 3D processor architecture. The researchers used the MTJs to construct a spin-transfer torque memory. Then, they used the spin-memories to drive reconfigurable 3D logic blocks fabricated with a standard 0.14μm CMOS process.

Comments

All comments

You need to be registered with the IET to leave a comment. Please log in or register as a new user.

IPRM InP & ISCS Compound Semiconductors Supply Chain For GaAs, GaP, GaN,

InP, Sic, and Sapphire

Acme Corporation, AdTech, Agility, Alpha Crystal, Alphion, Ammono Sp, Anadigic, AOI, Avago, Avanex, AWSC, AXT, Bookham, Bridgestone, ComSeCore, Cotomat, Covega, Cree, Crysband, Crystal Applied Technology, Crystal On, Crystal Photonics, Crystal Q, Crystalwise, Cyoptics, Denselight, Denso, Dow Corning, Dowa, DTI/ Ding Ten, Elma Malachit JSC, Epistar, Epiworks, Eudyna, Exiton, Finisar, Freiberger, Fujitsu, Furukawa, GCS, GE, GigaCom, Goldeneye Inc., Hitachi(OpNext), Hitachi Cable, Hittite Microwave, HRL, II/VI, IIjin Display, Infinera, Inlustra Technologies LLC, InPACT, IntelliEPI, Intexys Photonics, IQE, JDSU, Juropol, Kopin, Kyma, Kyocera, Lumileds, LumiLOG, M/A-Com, Magnachip, Mimix Broadband, Mitsubishi Chemical, Mitsubishi Electric, MJ Corporation, Modulight, Monocrystal PLC, Multiplex,Namiki, NanoGaN Ltd., N-Crystals, NEC, Neomax, NeosemiTech, Nikko, Materials / Acrotec, Nippon Steel, Norstel, Northrop Grumman, NTT, OKI, OMMIC, Ostendo, Oxford Inst. / TDI, PAM Xiamen, Panasonic, Peregrine, Phostec, Picogiga, Renesas, RMFD, Rohm, Rubicon, Saint-Gobain Crystals, Samsung-Corning, Santur, Sapphicon, Sapphire Technology, SEH, Sensor Electronic Technology: SET, Shinkosha, Showa Denko, SiCrystal, Silian, Sino American SAS, Shyworks, Sony, Soraa, Inc., sumika, Sumitomo Electric SEI, Sumitomo Metal Mining, Svedice, TankeBlue, Tera Xtal Technology, Thales, TOPCO Scientific, TopGaN, TriQuint, UCSB, UMS, Unipress, Vitesse, VPEC, Wafer Tech. / IQE, Wafer Works, Win Semi, Xiamen Powerway, Xindium.

InP, GaAs, Si, Sapphire, SiC, GaN Single Crystal Substrates Growth Rate vs. Price

DingTen Industrial Inc.

DingTen Industrial Inc.